IRS Latest Updates in 2023 ACA Reporting

IRS releases Final instructions for 2024 ACA Requirements..

Learn More

Reporting of ICHRA mandated by the IRS.

Learn More

Few states mandated ACA Reporting at the state level.

Learn MoreACA Reporting - An Overview

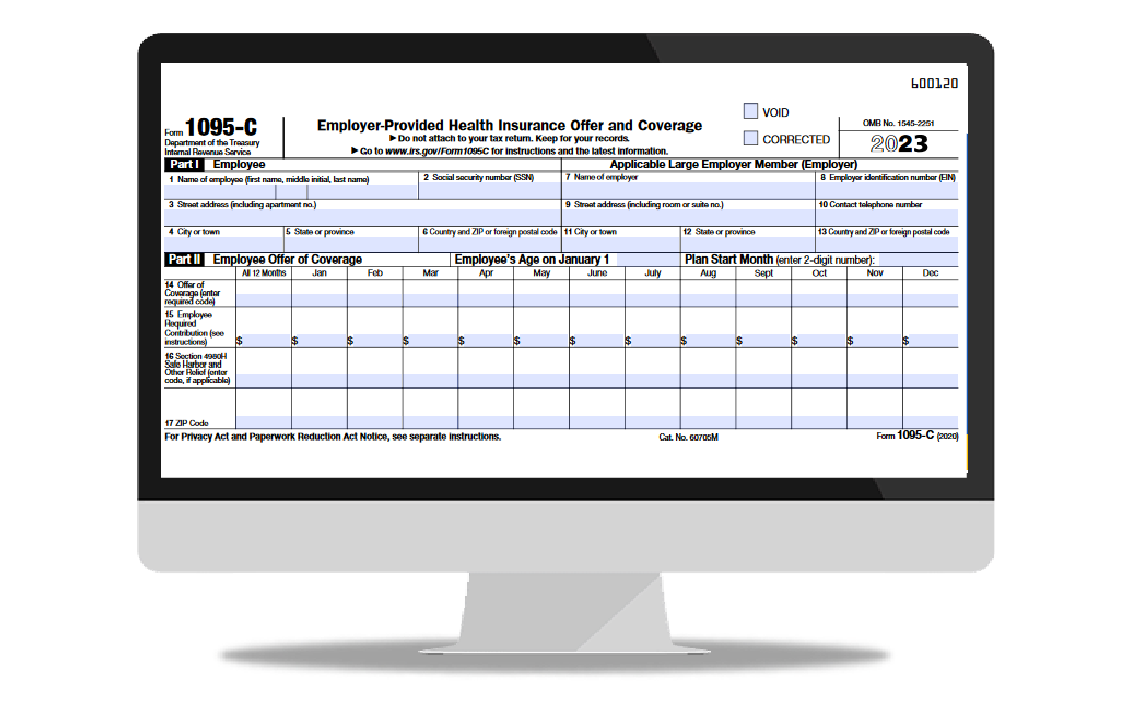

ACA reporting is a mandatory requirement for employers and other coverage providers to report to the IRS about their offered healthcare coverage.

- Employers with 50+ employees must use IRS Form 1095-C to report the employee’s health coverage information.

- Employers with less than 50 employees and health coverage providers must use Form 1095-B to report about individuals who are covered by minimum essential coverage.

Click here to know more about ACA reporting.

Meet ACA Reporting Requirements Before these ACA

Filing Deadline

Recipient/Employee Copies Deadline

e-Filing Deadline

Paper Filing Deadline

Choose ACAwise to report your 2024 ACA Form 1094 and 1095-B/C before deadline & Stay Compliant..

A Simple ACA Reporting Service to E-file your 1095 Forms

We provide an easy-to-use ACA reporting service that allows employers to meet their IRS ACA reporting requirements without any trouble.

If you are a tax professional, we provide a secure portal to manage all your clients' ACA reporting process in one place. We offer flexible reporting services to file as part of our ACA filing solution.

Get Started with us today and e-file 1095- B/C securely to the IRS.

Our ACA Reporting Services

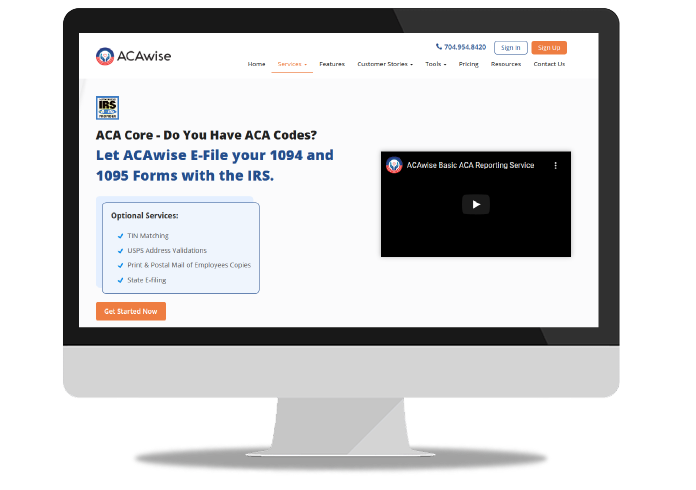

ACA Reporting Services - ACA Core

Do you have all your employee’s ACA data but feeling difficult to prepare and e-file with the IRS? Just access our ACA 1095 reporting solution. With our service, you just upload your employee’s health benefits data with ACA 1095-C Codes. We start generating the Forms and e-filing them with the IRS and State. This simplifies your year-end ACA filing so you can transmit your required ACA Forms to the IRS without any trouble.

- Upload ACA Data with Codes

- Data Validations

- Generate the ACA Forms

- Review & Approval

- E-file with the IRS and the States

- Employee Copy Distribution

ACA Reporting Services - ACA Elite

Nearing the 2024 ACA reporting, are you not sure how to generate the form with the required ACA codes and e-file with the IRS? Just provide us your payroll, health benefits, employee census data with us. We take care of generating and e-filing your Form 1095-B/C with required lines 14 and 16 ACA Codes. We also perform TIN Matching, IRS Business Rules, Data Integrity Checks, XML Schema, USPS address validations to ensure the returns are accurate for transmission.

- Upload payroll, benefits, employee census data

- Data Validations

- Generate the ACA Forms

- Review & Approval

- E-file with the IRS and the States

- Employee Copy Distribution

Exclusive Features of Our ACA Reporting Service

Data Handling in

multiple formats

TPA Control

Panel

Risk Audit

IRS & State

E-Filing

Employee Copy Distribution

Form Corrections

Visit https://www.acawise.com/aca-reporting-software/, to know more about our ACA 1095

Reporting Software.

A Quick Guide for Employers

ACAwise has created a Free guide to help applicable large employers to know 2024 ACA Reporting Requirements and ACA Codes better.

State Mandate ACA Reporting Requirements for 2024

After eliminating the federal individual mandate penalty under the ACA by Congress in 2019, few states have implemented the individual mandate at the state level. So, in addition to federal ACA reporting, employers who employ those state individuals are now required to file their employees health coverage information to the state and furnish copies to their employees. The states such as California, District of Columbia, Massachusetts, New Jersey, Rhode Island, Vermont have passed individual mandates which require employers to provide Minimum Essential Coverage to their residents and report it to them through the ACA Forms and MA Form 1099-HC. Few more states such as Connecticut, Hawaii, Maryland, Minnesota, Washington are considering passing the individual mandate at the state level.

If you are looking for State Mandate ACA reporting, contact ACAwise, we support e-filing of ACA Forms 1095-B/C and MA Form 1099-HC

with the States.

ICHRA Reporting on ACA Forms

New rules regarding ICHRAs have been launched in 2020 and these plans are now emerging among employers. An ICHRA is an employer-sponsored reimbursement plan, which allows employees to purchase their individual health insurance plan in the marketplace. In turn, the plan reimburses the employee up to their allowance amount to help them cover a portion of their medical costs and/or premiums. According to the ACA reporting requirements, employers are responsible for reporting the ICHRA coverage information to the IRS and furnishing the copies to employees.

If you are looking for the ACA reporting service, get in touch with ACAwise, we will take care of generating the ICHRA codes and e-file it with the IRS, and distribute the copies to the employees.

ACA Reporting Helpful Resources

Get Access to Our ACA Reporting Service

If you have any queries related to our service, you can get in touch with our support team at 704-954-8420 or send us an email at support@acawise.com.